missouri employer payroll tax calculator

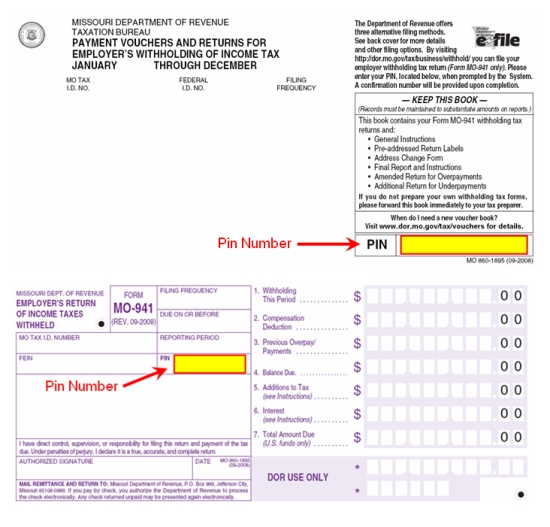

If you have misplaced this identification number and are an authorized person for the account you may call 573 751-5860 to obtain. This tax is a.

Tax Professionals can use the calculator when testing new tax software or assisting with tax planning.

. Employers can use the calculator rather than manually looking up withholding tax in tables. That tax rate hasnt changed since 1993. Its a progressive income tax meaning the more money.

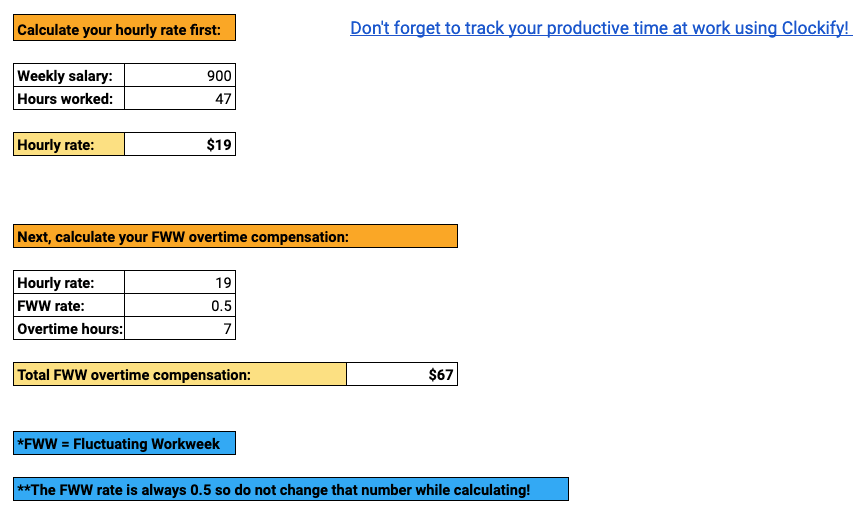

Missouri Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. The maximum an employee will pay in 2022 is 911400. The first step is to calculate the payroll tax in Missouri with the Missouri payroll tax calculator and apply the state tax rate to the earnings of all firms starting at 15.

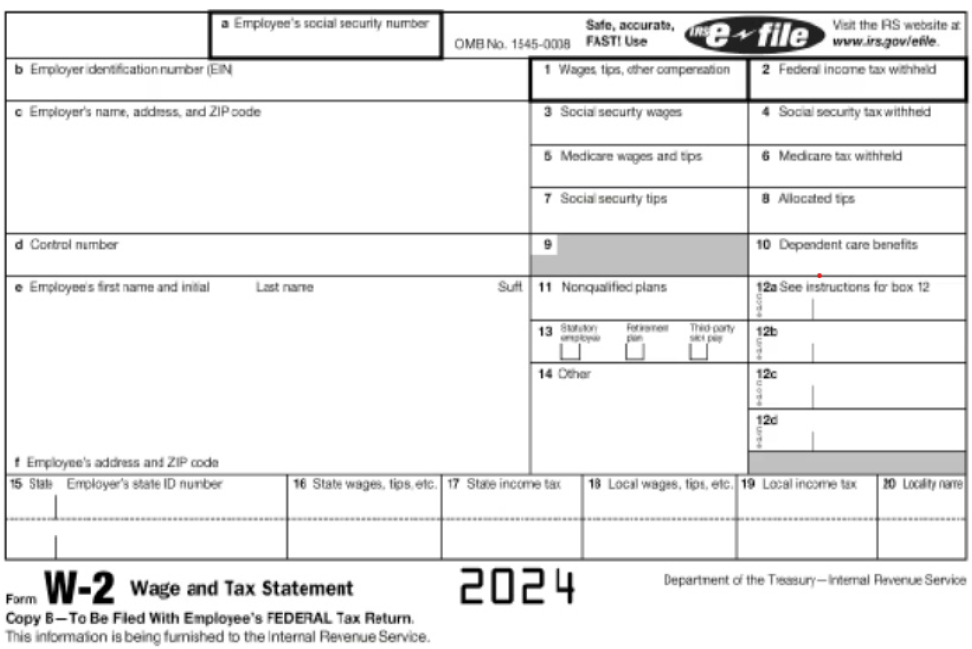

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Paycheck calculators Payroll tax rates Withholding forms Small business guides.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Missouri Tax Registration Application Form 2643. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide Form 4282 and withholding tax calculator have been updated.

Employer tax in Georgia employee tax. Below are your Missouri salary paycheck results. Figure out your filing status work out your adjusted gross income Net income Adjustments.

Missouri Payroll for Employers. Employer Withholding Tax - Missouri The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated. Employees with multiple employers.

However you can also claim a tax credit of up to 54 a max of 378. Employers covered by Missouris wage payment law must pay wages at least semi-monthly. Brush up your resume sign up for training and create an online profile with.

If you work for yourself you need to pay the self-employment tax which is equal to both the. The results are broken up into three sections. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15.

Payroll Tax Salary Paycheck Calculator Missouri Paycheck Calculator Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Missouri Hourly Paycheck Calculator Results. All corporations and manufacturers doing business in the state.

Missouri Cigarette Tax. If an employer pays state taxes timely the 6 rate will be reduced by 54 and the employer will pay their federal UI tax at a rate of 6. Paycheck Withholding Calculator Statement of Account.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

![]()

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Motax Missouri Taxpayer Education Initiative Programs Mu Extension

Payroll Tax Rates 2022 Guide Forbes Advisor

Payroll Tax Calculator Fingercheck

Nanny Tax Payroll Calculator Gtm Payroll Services

Payroll Tax Calculator For Employers Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Missouri Household Employment Tax And Labor Law Guide Care Com Homepay

Relief In Employment Tax Cases With The Irs Silver Law Plc

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Missouri Discount Timely Compensation Deduction Information

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Withholding Tax Credit Inquiry Instructions

Ten Tax Reform Implications For The Service Industry Our Insights Plante Moran